Home > Case Study > LLM Case Studies > ICICI LLM Strategy Case Study

The Client

ICICI Prudential Life Insurance Company Ltd. is one of India’s leading private life insurance providers, committed to protecting lives and ensuring financial security for millions of Indians. The company offers a comprehensive range of life insurance products, including term insurance, ULIP, retirement, pension, and annuity plans, helping customers plan for every life stage.

With a strong digital presence and customer-first approach, ICICI Prudential continues to pioneer innovation in the insurance industry through technology-driven solutions that simplify the protection and investment journey.

The Objective

As the search landscape evolved toward AI Overviews and LLM-powered discovery platforms, ICICI Prudential sought to expand its organic visibility beyond traditional SEO rankings.

The objective was to strengthen brand discoverability across Google’s AI Overviews and LLM-based ecosystems such as ChatGPT, Gemini, and Perplexity, ensuring ICICI Prudential’s content was referenced as a trusted authority in life insurance, term insurance, and financial planning conversations.

Planned KPIs:

- Improve keyword coverage and brand visibility within Google’s AI Overviews.

- Achieve measurable growth in traffic originating from LLM platforms.

Strengthen brand mentions and contextual authority in AI-generated summaries across major LLMs.

Rewrite Your SEO With AI-Driven Precision.

Our LLM-powered insights help brands uncover hidden opportunities and scale smarter, faster.

The Challenge

Before implementing AI SEO, ICICI Prudential’s website faced several AI-readiness challenges:

- Limited Entity Depth:

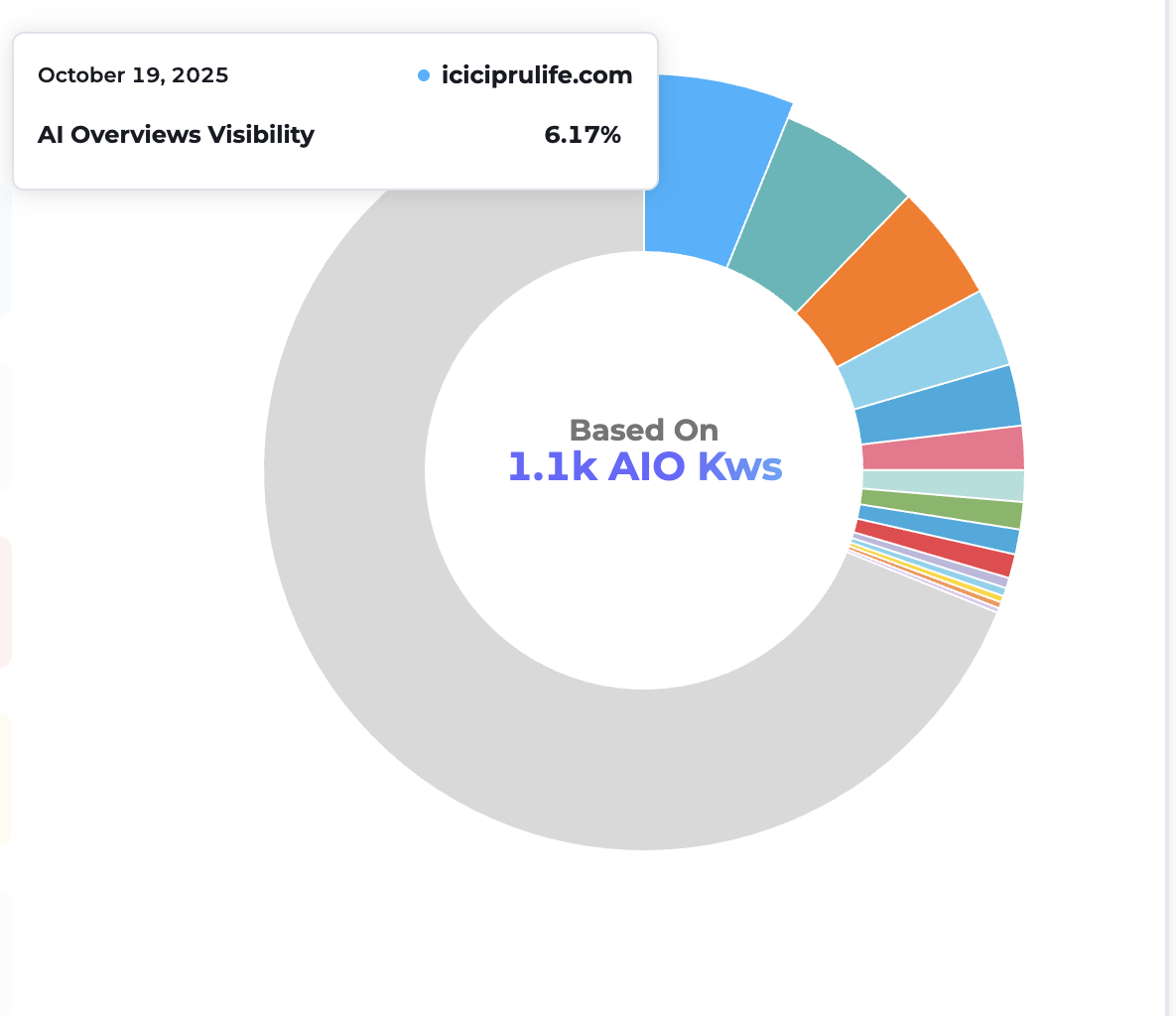

While content was optimized for SEO, it lacked semantic connections and structured data that help AI systems understand and cite authoritative sources. - Low AI Overview Visibility:

In early tracking, the AI Overview share stood at just 2.9%, and the website appeared for fewer than 200 AI Overview-triggering keywords. - Minimal LLM Referrals:

Traffic from platforms like ChatGPT and Gemini was negligible, with limited brand citations in generative search results.

The Solution

Infidigit implemented a comprehensive AEO (AI Overview Optimization) and GEO (Generative Engine Optimization) framework tailored to the life insurance domain.

1. AI-Ready Content Framework

Key landing pages (Term Insurance, ULIP, Pension, Retirement, Annuity, and Tax Savings) were optimized with entity-driven, structured, and contextually rich content.

This helped AI systems recognise ICICI Prudential as a credible authority on financial protection topics.

2. Conversational Content Targeting LLM Queries

Using Infigrowth’s LLM Visibility Module, Infidigit identified user questions frequently surfaced in generative searches — such as “What is term insurance?” and “Which life insurance plan is best for retirement?” — and optimized FAQ structures and content to increase brand inclusion.

3. Schema & Structured Data Enhancement

Advanced schema types, including Organization, Product, FAQ, and Dataset, were implemented to improve machine interpretability and align with AI Overview eligibility criteria.

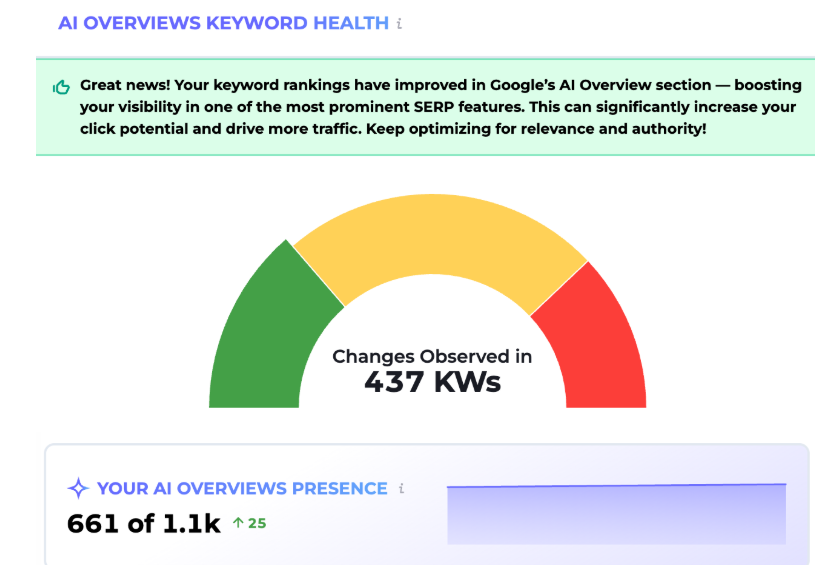

4. AI Overview Tracking & Real-Time Optimization via Infigrowth

Infidigit leveraged its proprietary tool Infigrowth to monitor AI Overview keyword performance, track emerging queries, and dynamically adapt on-page optimizations based on AI visibility patterns.

5. Entity & Authority Building

Infidigit strengthened the semantic relationship between ICICI Prudential, life insurance, term plans, and financial security, complemented by authoritative backlinks and topical clusters focused on financial literacy and insurance education.

- Do’s

- Create context-rich, factually accurate content.

- Use structured data to help AI understand intent.

- Keep content updated and authoritative.

- Monitor AI Overviews for visibility trends.

- Don’ts

- Don’t stuff keywords or rely on old SEO tricks.

- Don’t use AI content without human review.

- Don’t ignore entities like brand or author data.

- Don’t publish surface-level or generic content.

The Result

- Secured 1,093 keyword placements within Google’s AI Overviews.

- Achieved a 39x increase in sessions from LLM platforms (ChatGPT, Gemini, Perplexity).

- Notable improvement in brand mention frequency across AI-generated responses related to insurance and financial planning.

Before

- AI Overview Share: 2.9%

- AI Overview Keywords: ~200

- LLM Traffic: Minimal

- Brand Mentions in Generative Platforms: Rare

After

- AI Overview Share: 4.1%

- AI Overview Keywords: 1,093

- LLM Traffic: 39x growth

Brand Mentions: Consistent presence in AI summaries and chat responses

Infidigit’s AI SEO Framework for ICICI Prudential

Focus Area | Strategy Implemented | Outcome |

AI Overview Keyword Targeting | Identified & optimized 1,000+ AI Overview-triggering queries using Infigrowth | 1,093 placements achieved |

Entity Optimization | Strengthened linkages between ICICI Prudential, Life Insurance, ULIP, Term Plans | Higher AI interpretability |

Conversational SEO | Created LLM-friendly FAQs & long-tail conversational clusters | Improved ChatGPT & Gemini mentions |

Structured Data Implementation | Added Organization, Product, FAQ, Dataset schemas | Better AI discoverability |

Authority Building | Contextual backlinks & semantic topic clusters | Enhanced trust signals |

The Impact

Through a data-led approach combining AEO, GEO, and AI analytics, ICICI Prudential became one of India’s first insurance brands to achieve consistent visibility across Google’s AI Overviews and LLM-driven platforms.

This case sets a benchmark for how financial brands can embrace AI SEO to future-proof their discoverability and strengthen digital trust.

60+

Client Testimonial

200+

Global Brands

70+

Awards & Recognition

130+

Success Stories

Beauty & Fitness

Health

Our Solutions

Free

Scale Smarter With AI-Optimized SEO

Use LLM insights to refine content, strengthen authority, and grow faster.

200+ brands scaled revenue using our data-backed playbook.

Let’s Begin with Your Details

- Your data is properly secured encrypted by SSL.

- We hate spam too, your inbox is safe with us.

How useful was this post?

0 / 5. 0